Amongst several new provisions, the main adjust of your BAPCPA was the development of the “signifies test.” This test steps a purchaser’s revenue versus the median (regular) money for his or her condition to find out if you are eligible to file for bankruptcy in any way.In Chapter thirteen, your repayment prepare relies on your profits and ch

Fascination About Do I Need To Be Employed To File Bankruptcy

In many predicaments, bankruptcy will not have an affect on your present work. On the other hand, bankruptcy could prevent you from obtaining a career in non-public business.Most often, unemployed people today will pass the means test. Getting Unemployed When Submitting for Chapter thirteen Bankruptcy Chapter 13 needs you to repay debts around a pe

Scott Baio Then & Now!

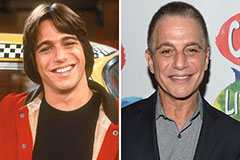

Scott Baio Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now!